Anyfin

Description of Anyfin

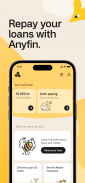

দেখুন আমরা আপনার কিস্তির পেমেন্ট, ক্রেডিট কার্ডের ঋণ এবং ব্যক্তিগত ঋণের সুদ কমাতে পারি কিনা। আপনি যখন সেগুলি আমাদের কাছে স্থানান্তরিত করেন, আপনি সর্বদা দ্রুত হারে পরিশোধ করতে বেছে নিতে পারেন।

- সমস্ত ঋণ এক জায়গায় সংগ্রহ করুন এবং আপনি কীভাবে তাদের পরিশোধ করবেন তার একটি ওভারভিউ পান।

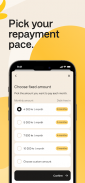

- আপনার কিস্তির পরিকল্পনা সেট করুন।

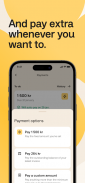

- এটি আপনার উপযুক্ত হলে অতিরিক্ত অর্থ প্রদান করুন।

সুদ কম দিন, বেশি শোধ করুন।

যখন কম টাকা সুদের কাছে যায়, তখন ঋণ পরিশোধে বেশি যেতে পারে। আপনি যত দ্রুত পরিশোধ করবেন, ঋণের মোট খরচ তত কম হবে।

সদস্যতা পরীক্ষা করুন.

আপনি যে জিনিসগুলি ব্যবহার করেন না তার জন্য অর্থ প্রদান করছেন? অ্যাপটিতে, আপনি আপনার সমস্ত সদস্যতা, সদস্যতা এবং নির্দিষ্ট খরচ এক জায়গায় দেখতে পাবেন। আপনি একটি বা দুটি ক্লিকের মাধ্যমে সরাসরি অ্যাপে ব্যবহার করেন না এমন জিনিসগুলিও বাতিল করতে পারেন৷ হয়তো আপনি সেই অর্থ ব্যবহার করে ঋণের অতিরিক্ত অর্থ প্রদান করতে পারেন।

Anyfin অ্যাপে সরাসরি আপনার UC গ্রেড দেখুন।

UC এর সাথে একসাথে, আমরা UC চেক তৈরি করেছি, যেখানে আপনি সরাসরি আমাদের অ্যাপে আপনার ক্রেডিট স্কোর দেখতে পাবেন। এটি সম্পূর্ণ বিনামূল্যে এবং আপনার রেটিং প্রভাবিত করে না।

আপনার ঋণের মাসিক খরচ বিমা করুন।

আপনি অসুস্থ বা অনিচ্ছাকৃতভাবে বেকার হয়ে পড়লে Anyfin এর সামাজিক নিরাপত্তা বীমা আপনাকে আপনার সবচেয়ে গুরুত্বপূর্ণ মাসিক খরচ পরিশোধ করতে সাহায্য করতে পারে। আপনি যে মাসিক পরিমাণ বীমা করতে চান তা চয়ন করুন (প্রতি মাসে 10,000 SEK পর্যন্ত)।

নোট! ধারে টাকা খরচ হয়।

আপনি যদি সময়মতো ঋণ পরিশোধ করতে না পারেন, তাহলে আপনি একটি অর্থপ্রদানের নোটিশের ঝুঁকি নিতে পারেন। এর ফলে আবাসন ভাড়া নেওয়া, সাবস্ক্রিপশন নেওয়া এবং নতুন ঋণ পেতে অসুবিধা হতে পারে। সহায়তার জন্য, আপনার পৌরসভার বাজেট এবং ঋণ পরামর্শের সাথে যোগাযোগ করুন। যোগাযোগের তথ্য konsumerverket.se এ উপলব্ধ।

গণনার উদাহরণ

14.16% নামমাত্র সুদের হারে (পরিবর্তনশীল) SEK 1,051-এর 60টি কিস্তির সাথে 60 মাসের পরিশোধের মেয়াদ সহ SEK 45,000 এর একটি পুনঃঅর্থায়ন ঋণ মোট 15.12% কার্যকর সুদের হার দেয়। মোট পরিশোধ করতে হবে SEK 63,048৷

Anyfin এর সাথে পুনঃঅর্থায়ন করা যেতে পারে সর্বাধিক পরিমাণ হল SEK 500,000৷ বর্তমান মেয়াদের উপর নির্ভর করে মেয়াদটি 1 মাস এবং 180 মাস পর্যন্ত দীর্ঘ হতে পারে। নামমাত্র সুদের হার 6.98% হিসাবে কম এবং 23.00% পর্যন্ত হতে পারে। কার্যকর সুদের হার 7.21% হিসাবে কম এবং 25.59% পর্যন্ত হতে পারে।